For starters, you can only deduct losses up to the amount of your winnings, so any excess loss can't offset other highly taxed income. Conversely, you might show a taxable profit. Suppose you have annual gambling winnings of $10,000 for 2017 and losses of $2,500. As a result, you can deduct $2,500, but you're taxed on the $7,500 difference.

By Brad Polizzano, J.D., LL.M., New York City

Totaling a taxpayer's Forms W-2G, Certain Gambling Winnings St croix casino hertel express. , for the year would seem to be the straightforward way to determine the amount of gambling winnings to report on a tax return. Forms W-2G, however, do not necessarily capture all of a taxpayer's gambling winnings and losses for the year. How are these amounts reported and substantiated on a tax return? Does the answer change if the taxpayer seeks to make a living as a poker player? Do states tax gambling differently?

There are many nuances and recent developments under federal and state tax laws about gambling and other similar activities. With proper recordkeeping and guidance, a taxpayer with gambling winnings may significantly reduce audit exposure.

Income and Permitted Deductions

- The Appellate Division has confirmed the decision of the Tax Appeals Tribunal that, under New York law, a taxpayer's personal deductions, including those for gambling losses, were reduced by 25%.

- Your gambling losses are federal itemized deduction on schedule A. You may or may not benefit based on your other itemized ductions and your overall tax situation. Then for your New York State return, you will either use your federal itemized deductions plus certain state adjustments, or you will use the New York state standard deduction.

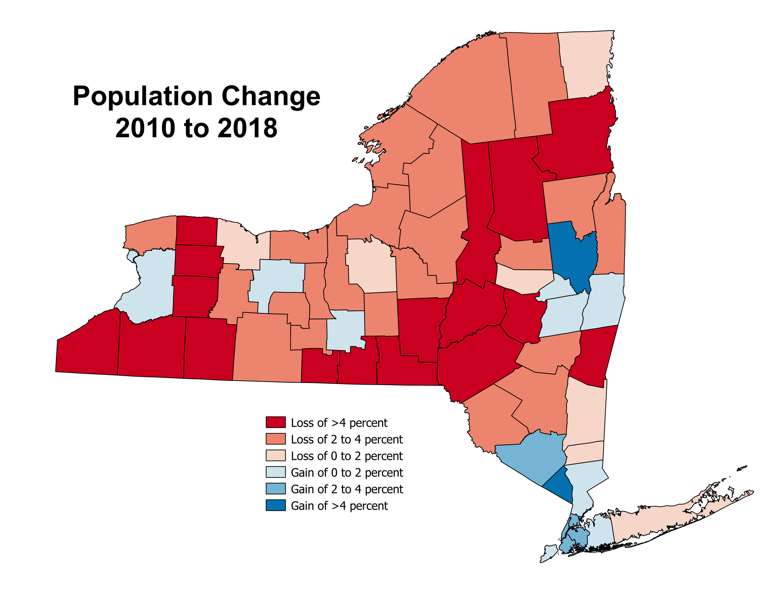

- The only state in our survey that does not tax nonresidents ' winnings from these forms of gambling is New York. The remaining states tax winnings, although some require winnings to exceed a certain threshold or allow nonresidents to offset winnings with losses. The state with the highest number of casinos according to the AGA survey is Nevada.

- New York's top state tax rate is 8.82% as of 2020, but then you'll have to add another percentage for the local tax. That works out to a hefty 12.7% of your winnings. Your tax bill would come out to almost $127,000 on $1 million in winnings, and about $12.7 million if you won a $100 million lottery.

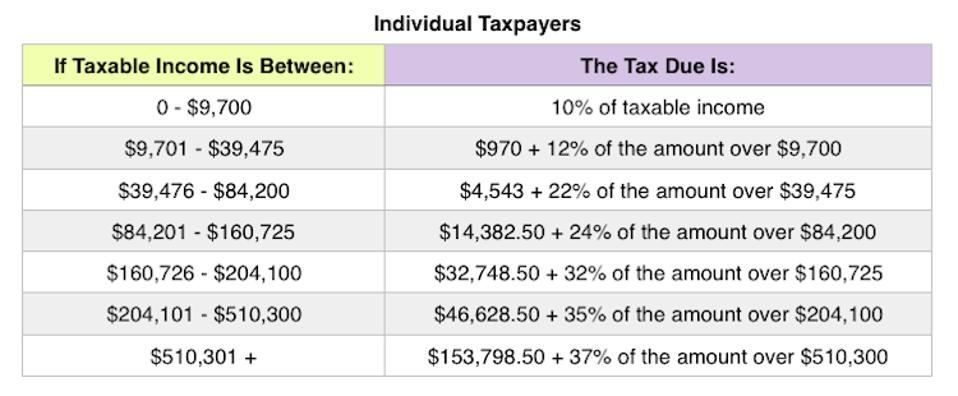

Under Sec. 61(a), all income from whatever source derived is includible in a U.S. resident's gross income. Whether the gambling winnings are $5 or $500,000, all amounts are taxable.

A taxpayer may deduct losses from wagering transactions to the extent of gains from those transactions under Sec. 165(d). For amateur gamblers, gambling losses are reported as an itemized deduction on Schedule A, Itemized Deductions. The law is not as kind to nonresidents: While nonresidents must also include U.S.-source gambling winnings as income, they cannot deduct gambling losses against those winnings. Nonresidents whose gambling winnings are connected to a trade or business may deduct gambling losses to the extent of winnings, however, under Sec. 873.

Case law and IRS guidance have established that a taxpayer may determine gambling winnings and losses on a session basis.

Neither the Code nor the regulations define the term 'transactions' as stated in Sec. 165(d). Tax Court cases have recognized that gross income from slot machine transactions is determined on a session basis (see Shollenberger, T.C. Memo. 2009-306; LaPlante, T.C. Memo. 2009-226).

What Is a Session?

In 2008, the IRS Chief Counsel opined that a slot machine player recognizes a wagering gain or loss at the time she redeems her tokens because fluctuating wins and losses left in play are not accessions to wealth until the taxpayer can definitely calculate the amount realized (Advice Memorandum 2008-011). This method is also recognized in both Schollenberger and LaPlante, as a by-bet method would be unduly burdensome and unreasonable for taxpayers. To this end, the IRS issued Notice 2015-21, which provides taxpayers a proposed safe harbor to determine gains or losses from electronically tracked slot machine play.

Under Notice 2015-21, a taxpayer determines wagering gain or loss from electronically tracked slot machine play at the end of a single session of play, rather than on a by-bet basis. Electronically tracked slot machine play uses an electronic player system controlled by the gaming establishment—such as the use of a player's card—that records the amount a specific individual won and wagered on slot machine play. A single session of play begins when a taxpayer places a wager on a particular type of game and ends when the taxpayer completes his or her last wager on the same type of game before the end of the same calendar day.

A taxpayer recognizes a wagering gain if, at the end of a single session of play, the total dollar amount of payouts from electronically tracked slot machine play during that session exceeds the total dollar amount of wagers placed by the taxpayer on the electronically tracked slot machine play during that session. A taxpayer recognizes a wagering loss if, at the end of a single session of play, the total dollar amount of wagers placed by the taxpayer on electronically tracked slot machine play exceeds the total dollar amount of payouts from electronically tracked slot machine play during the session.

There is little to no guidance defining a session for other casino games, such as poker. Furthermore, because there are different poker game formats (cash and tournament) and game types (Texas hold 'em, pot limit Omaha, etc.), it is unclear whether the one-session-per-day analysis would apply to poker in general. A taxpayer who plays different types of poker games may have to record separate sessions for each type of poker game played each day.

In a 2015 Chief Counsel memorandum (CCM), the IRS concluded that a taxpayer's multiple buy-ins for the same poker tournament could not be aggregated for purposes of determining the reportable amount on a taxpayer's Form W-2G (CCM 20153601F). This analysis implies that the IRS may view each poker tournament buy-in as a separate gambling session. A key point leading to the conclusion was that the buy-ins were not identical because the tournament circumstances were different each time the taxpayer made an additional buy-in.

Requirement to Maintain Accurate Records

In Rev. Proc. 77-29, the IRS states that a taxpayer must keep an accurate diary or other similar record of all losses and winnings. According to Rev. Proc. 77-29, the diary should contain:

- The date and type of the specific wager or wagering activity;

- The name and address or location of the gambling establishment;

- The names of other persons present at the gambling establishment; and

- The amounts won or lost.

It is hard to believe the IRS would disallow a taxpayer's gambling loss deduction solely because the taxpayer did not write down in her diary the names of other persons at her blackjack table. The IRS does acknowledge that a taxpayer may prove winnings and losses with other documentation, such as statements of actual winnings from the gambling establishment.

Special Rules for Professional Gamblers

The professional gambler reports gambling winnings and losses for federal purposes on Schedule C, Profit or Loss From Business. A professional gambler is viewed as engaged in the trade or business of gambling. To compute business income, the taxpayer may net all wagering activity but cannot report an overall wagering loss. In addition, the taxpayer may deduct 'ordinary and necessary' business expenses (expenses other than wagers) incurred in connection with the business.

Whether a gambler is an amateur or a professional for tax purposes is based on the 'facts and circumstances.' In Groetzinger, 480 U.S. 23 (1987), the Supreme Court established the professional gambler standard: 'If one's gambling activity is pursued full time, in good faith, and with regularity, to the production of income for a livelihood, and is not a mere hobby, it is a trade or business.' The burden of proof is on the professional gambler to prove this status.

Despite receiving other forms of income in 1978, Robert Groetzinger was held to be a professional gambler for the year because he spent 60 to 80 hours per week gambling at dog races. Gambling was his full-time job and livelihood. Notably, Groetzinger had a net gambling loss in 1978. Thus, actual profit is not a requirement for professional gambler status.

In addition to applying the standard established in Groetzinger, courts sometimes apply the following nonexhaustive nine-factor test in Regs. Sec. 1.183-2(b)(1) used to determine intent to make a profit under the hobby loss rules to decide whether a taxpayer is a professional gambler:

- Manner in which the taxpayer carries on the activity;

- The expertise of the taxpayer or his advisers;

- The time and effort the taxpayer expended in carrying on the activity;

- Expectation that assets used in the activity may appreciate in value;

- The taxpayer's success in carrying on other similar or dissimilar activities;

- The taxpayer's history of income or losses with respect to the activity;

- The amount of occasional profits, if any, that are earned;

- The financial status of the taxpayer; and

- Elements of personal pleasure or recreation.

What if a professional gambler's ordinary and necessary business expenses exceed the net gambling winnings for the year? In Mayo, 136 T.C. 81 (2011), the court held the limitation on deducting gambling losses does not apply to ordinary and necessary business expenses incurred in connection with the trade or business of gambling. Therefore, a professional gambler may report a business loss, which may be applied against other income from the year.

Limitations on Loss Deductions

Some states do not permit amateur taxpayers to deduct gambling losses as an itemized deduction at all. These states include Connecticut, Illinois, Indiana, Kansas, Massachusetts, Michigan, North Carolina, Ohio, Rhode Island, West Virginia, and Wisconsin. A taxpayer who has $50,000 of gambling winnings and $50,000 of gambling losses in Wisconsin for a tax year, for example, must pay Wisconsin income tax on the $50,000 of gambling winnings despite breaking even from gambling for the year.

Because professional gamblers may deduct gambling losses for state income tax purposes, some state tax agencies aggressively challenge a taxpayer's professional gambler status. A taxpayer whose professional gambler status is disallowed could face a particularly egregious state income tax deficiency if the taxpayer reported on Schedule C the total of Forms W-2G instead of using the session method under Notice 2015-21. In this situation, the state may be willing to consider adjusting the assessment based on the session method if the taxpayer provides sufficient documentation.

New York State Tax Gambling Losses Tax

Changes Ahead Likely

New York State Gambling Losses Income Tax

Tax laws addressing gambling and other similar activities will continue to evolve as new types of games and technologies emerge. Some related tax issues that will come to the forefront include session treatment for online gambling activity and whether daily fantasy sports are considered gambling. As more and more states legalize online gambling and daily fantasy sports, Congress or the IRS will have no choice but to address these issues.

Totaling a taxpayer's Forms W-2G, Certain Gambling Winnings St croix casino hertel express. , for the year would seem to be the straightforward way to determine the amount of gambling winnings to report on a tax return. Forms W-2G, however, do not necessarily capture all of a taxpayer's gambling winnings and losses for the year. How are these amounts reported and substantiated on a tax return? Does the answer change if the taxpayer seeks to make a living as a poker player? Do states tax gambling differently?

There are many nuances and recent developments under federal and state tax laws about gambling and other similar activities. With proper recordkeeping and guidance, a taxpayer with gambling winnings may significantly reduce audit exposure.

Income and Permitted Deductions

- The Appellate Division has confirmed the decision of the Tax Appeals Tribunal that, under New York law, a taxpayer's personal deductions, including those for gambling losses, were reduced by 25%.

- Your gambling losses are federal itemized deduction on schedule A. You may or may not benefit based on your other itemized ductions and your overall tax situation. Then for your New York State return, you will either use your federal itemized deductions plus certain state adjustments, or you will use the New York state standard deduction.

- The only state in our survey that does not tax nonresidents ' winnings from these forms of gambling is New York. The remaining states tax winnings, although some require winnings to exceed a certain threshold or allow nonresidents to offset winnings with losses. The state with the highest number of casinos according to the AGA survey is Nevada.

- New York's top state tax rate is 8.82% as of 2020, but then you'll have to add another percentage for the local tax. That works out to a hefty 12.7% of your winnings. Your tax bill would come out to almost $127,000 on $1 million in winnings, and about $12.7 million if you won a $100 million lottery.

Under Sec. 61(a), all income from whatever source derived is includible in a U.S. resident's gross income. Whether the gambling winnings are $5 or $500,000, all amounts are taxable.

A taxpayer may deduct losses from wagering transactions to the extent of gains from those transactions under Sec. 165(d). For amateur gamblers, gambling losses are reported as an itemized deduction on Schedule A, Itemized Deductions. The law is not as kind to nonresidents: While nonresidents must also include U.S.-source gambling winnings as income, they cannot deduct gambling losses against those winnings. Nonresidents whose gambling winnings are connected to a trade or business may deduct gambling losses to the extent of winnings, however, under Sec. 873.

Case law and IRS guidance have established that a taxpayer may determine gambling winnings and losses on a session basis.

Neither the Code nor the regulations define the term 'transactions' as stated in Sec. 165(d). Tax Court cases have recognized that gross income from slot machine transactions is determined on a session basis (see Shollenberger, T.C. Memo. 2009-306; LaPlante, T.C. Memo. 2009-226).

What Is a Session?

In 2008, the IRS Chief Counsel opined that a slot machine player recognizes a wagering gain or loss at the time she redeems her tokens because fluctuating wins and losses left in play are not accessions to wealth until the taxpayer can definitely calculate the amount realized (Advice Memorandum 2008-011). This method is also recognized in both Schollenberger and LaPlante, as a by-bet method would be unduly burdensome and unreasonable for taxpayers. To this end, the IRS issued Notice 2015-21, which provides taxpayers a proposed safe harbor to determine gains or losses from electronically tracked slot machine play.

Under Notice 2015-21, a taxpayer determines wagering gain or loss from electronically tracked slot machine play at the end of a single session of play, rather than on a by-bet basis. Electronically tracked slot machine play uses an electronic player system controlled by the gaming establishment—such as the use of a player's card—that records the amount a specific individual won and wagered on slot machine play. A single session of play begins when a taxpayer places a wager on a particular type of game and ends when the taxpayer completes his or her last wager on the same type of game before the end of the same calendar day.

A taxpayer recognizes a wagering gain if, at the end of a single session of play, the total dollar amount of payouts from electronically tracked slot machine play during that session exceeds the total dollar amount of wagers placed by the taxpayer on the electronically tracked slot machine play during that session. A taxpayer recognizes a wagering loss if, at the end of a single session of play, the total dollar amount of wagers placed by the taxpayer on electronically tracked slot machine play exceeds the total dollar amount of payouts from electronically tracked slot machine play during the session.

There is little to no guidance defining a session for other casino games, such as poker. Furthermore, because there are different poker game formats (cash and tournament) and game types (Texas hold 'em, pot limit Omaha, etc.), it is unclear whether the one-session-per-day analysis would apply to poker in general. A taxpayer who plays different types of poker games may have to record separate sessions for each type of poker game played each day.

In a 2015 Chief Counsel memorandum (CCM), the IRS concluded that a taxpayer's multiple buy-ins for the same poker tournament could not be aggregated for purposes of determining the reportable amount on a taxpayer's Form W-2G (CCM 20153601F). This analysis implies that the IRS may view each poker tournament buy-in as a separate gambling session. A key point leading to the conclusion was that the buy-ins were not identical because the tournament circumstances were different each time the taxpayer made an additional buy-in.

Requirement to Maintain Accurate Records

In Rev. Proc. 77-29, the IRS states that a taxpayer must keep an accurate diary or other similar record of all losses and winnings. According to Rev. Proc. 77-29, the diary should contain:

- The date and type of the specific wager or wagering activity;

- The name and address or location of the gambling establishment;

- The names of other persons present at the gambling establishment; and

- The amounts won or lost.

It is hard to believe the IRS would disallow a taxpayer's gambling loss deduction solely because the taxpayer did not write down in her diary the names of other persons at her blackjack table. The IRS does acknowledge that a taxpayer may prove winnings and losses with other documentation, such as statements of actual winnings from the gambling establishment.

Special Rules for Professional Gamblers

The professional gambler reports gambling winnings and losses for federal purposes on Schedule C, Profit or Loss From Business. A professional gambler is viewed as engaged in the trade or business of gambling. To compute business income, the taxpayer may net all wagering activity but cannot report an overall wagering loss. In addition, the taxpayer may deduct 'ordinary and necessary' business expenses (expenses other than wagers) incurred in connection with the business.

Whether a gambler is an amateur or a professional for tax purposes is based on the 'facts and circumstances.' In Groetzinger, 480 U.S. 23 (1987), the Supreme Court established the professional gambler standard: 'If one's gambling activity is pursued full time, in good faith, and with regularity, to the production of income for a livelihood, and is not a mere hobby, it is a trade or business.' The burden of proof is on the professional gambler to prove this status.

Despite receiving other forms of income in 1978, Robert Groetzinger was held to be a professional gambler for the year because he spent 60 to 80 hours per week gambling at dog races. Gambling was his full-time job and livelihood. Notably, Groetzinger had a net gambling loss in 1978. Thus, actual profit is not a requirement for professional gambler status.

In addition to applying the standard established in Groetzinger, courts sometimes apply the following nonexhaustive nine-factor test in Regs. Sec. 1.183-2(b)(1) used to determine intent to make a profit under the hobby loss rules to decide whether a taxpayer is a professional gambler:

- Manner in which the taxpayer carries on the activity;

- The expertise of the taxpayer or his advisers;

- The time and effort the taxpayer expended in carrying on the activity;

- Expectation that assets used in the activity may appreciate in value;

- The taxpayer's success in carrying on other similar or dissimilar activities;

- The taxpayer's history of income or losses with respect to the activity;

- The amount of occasional profits, if any, that are earned;

- The financial status of the taxpayer; and

- Elements of personal pleasure or recreation.

What if a professional gambler's ordinary and necessary business expenses exceed the net gambling winnings for the year? In Mayo, 136 T.C. 81 (2011), the court held the limitation on deducting gambling losses does not apply to ordinary and necessary business expenses incurred in connection with the trade or business of gambling. Therefore, a professional gambler may report a business loss, which may be applied against other income from the year.

Limitations on Loss Deductions

Some states do not permit amateur taxpayers to deduct gambling losses as an itemized deduction at all. These states include Connecticut, Illinois, Indiana, Kansas, Massachusetts, Michigan, North Carolina, Ohio, Rhode Island, West Virginia, and Wisconsin. A taxpayer who has $50,000 of gambling winnings and $50,000 of gambling losses in Wisconsin for a tax year, for example, must pay Wisconsin income tax on the $50,000 of gambling winnings despite breaking even from gambling for the year.

Because professional gamblers may deduct gambling losses for state income tax purposes, some state tax agencies aggressively challenge a taxpayer's professional gambler status. A taxpayer whose professional gambler status is disallowed could face a particularly egregious state income tax deficiency if the taxpayer reported on Schedule C the total of Forms W-2G instead of using the session method under Notice 2015-21. In this situation, the state may be willing to consider adjusting the assessment based on the session method if the taxpayer provides sufficient documentation.

New York State Tax Gambling Losses Tax

Changes Ahead Likely

New York State Gambling Losses Income Tax

Tax laws addressing gambling and other similar activities will continue to evolve as new types of games and technologies emerge. Some related tax issues that will come to the forefront include session treatment for online gambling activity and whether daily fantasy sports are considered gambling. As more and more states legalize online gambling and daily fantasy sports, Congress or the IRS will have no choice but to address these issues.

EditorNotes

New York State Tax Gambling Losses Winnings

Mark Heroux is a principal with the Tax Services Group at Baker Tilly Virchow Krause LLP in Chicago.

For additional information about these items, contact Mr. Heroux at 312-729-8005 or mark.heroux@bakertilly.com.

New York State Tax Gambling Losses Rules

Unless otherwise noted, contributors are members of or associated with Baker Tilly Virchow Krause LLP.